Payroll & CIS

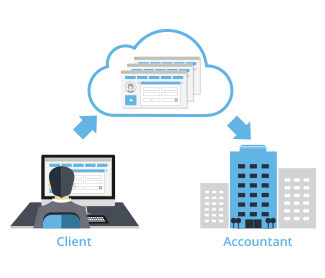

Letting McKellar Accountancy handle your payroll & CIS services can save you valuable time.

Our expert Payroll & CIS accountants not only ensures accurate calculations of employees’ tax and national insurance contributions but we can also work out the variables like sickness, paternity, or maternity leave.

Plus, we seamlessly handle CIS (Construction Industry Scheme) to account for any CIS suffered from your Contractors or deductions from your Subcontractors.

The process is simple we will take care of any calculations and distribute payslips or payment certificates directly to your employees or subcontractors, we’ve got you covered!

Employee Payroll Assistant Services, Renfrewshire, Paisley

We can take care of all of your payroll needs regardless of staff numbers.

We have a dedicated team that can assist with providing a comprehensive and confidential payroll service, including:

- Completion of statutory forms (including yearend returns)

- Compliance of submissions to HMRC in accordance with RTI

- Summaries and analysis of staff costs

- Administration of incentive schemes, bonuses, and ex-gratia and termination payments

- Administration of payroll auto-enrolment services

- payroll assistant paisley

Auto-Enrolment Services

We provide all auto-enrolment support in-house, giving our clients the security of knowing that each aspect is being dealt with by the same team, who are easy to get in contact with.

P11D Forms

When it comes to employers offering benefits in kind to employees and directors, reporting these to HMRC via a P11D form is standard procedure to ensure accurate tax payments.

- P11D Forms: Essential for reporting benefits in kind to HMRC.

- Understanding P11D Forms: Details benefits beyond cash, like company cars or gym memberships.

- Who Needs to Submit: Employers file separate forms for each employee or director receiving benefits.

- Form Contents: Includes personal details and benefits’ value and date; reflects tax already paid.

- VAT Inclusion: P11D form encompasses total VAT paid, regardless of VAT registration.

- Submission Methods: Options include payroll software, HMRC’s online service, or mail.

- P11D(b) Submission: Businesses disclose Class 1A National Insurance owed.

- Deadline: Forms due by July 6th after the tax year ends.

- Employee Copies: Employers must provide employees with P11D information; crucial for self-assessment.

Stress-free moving

Professionals in Payroll

At McKellar Accountancy, we take pride in offering exceptional payroll services tailored to the specific needs of your business. Our experienced team is committed to ensuring your payroll processes are:

- Accurate: We meticulously handle your payroll calculations to ensure precision.

- Compliant: We stay up-to-date with all relevant regulations to keep your business compliant.

- Efficient: Our streamlined processes save you time and reduce administrative burdens.

- Personalised: We customise our services to fit the unique requirements of your business.

Whether you run a small business or a large corporation, McKellar Accountancy has the expertise to manage your payroll with professionalism and reliability. Trust us to handle your payroll needs so you can focus on growing your business.

Payroll Services, Paisley Renfrewshire

Key features of using McKellar Accountancy Payroll Services

Key Benefits Include

- Employer Dashboard – Employers will have access to an overview of their payroll, a company annual leave calendar for all employees, payroll reports, employee information and more. Employers can authorise or approve employee requests such as a change of address or annual leave requests.

- Employee Self Service – Employees can access their own payroll information by logging into their personal portal. They can access their own personal leave calendar, view remaining holiday days, view sick leave taken, request annual leave, view and change their contact information, access payslips and other payroll and employment related documents.

Stress-free moving

Expert Accountants in CIS

As expert Accountants in CIS, McKellar Accountancy can help guide you and your business through the complex CIS tax rules. We understand the stress this can cause to many clients who just want to get on with running their business. At McKellar Accountancy we remove this stress for our clients and simplify the entire process from start to finish.

- Register your business as a contractor and/or subcontractor with HMRC

- Verify new subcontractors and inform you of the correct tax deduction rate.

- Send you a reminder every month when it is time to file your CIS return.

- Check all CIS tax deductions including materials.

- Complete payment and deductions statements for your subcontractors.

- Submit your monthly CIS return to HMRC.

- Register ourselves as your agent, allowing us to deal with all correspondence with HMRC.